Investing is a Results Oriented Business

How are Yours?

BUFFETT'S PHILOSOPHY

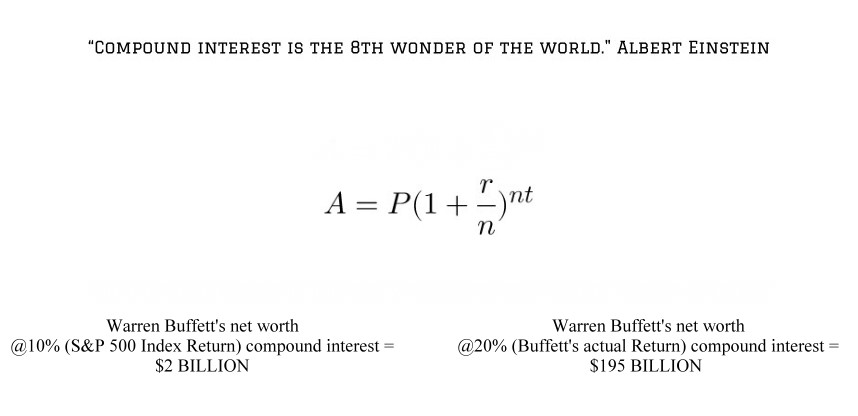

At The Buffett Way Financial Coaching, we are passionate disciples of Warren Buffett and value investing - The Buffett Way. Why? Because Warren Buffett’s easy to understand philosophy and simplistic principles have yielded the best results by far of any other financial professional in the world. More specifically, Berkshire Hathaway has an overall gain from 1965-2023 of 4,384,748% versus 31,223% for the S&P 500 Index which equates to a compounded annual gain of 19.8% v. 10.2% for the S&P 500 Index. (Click here for the full 2023 BRKA Annual Report). As an individual investor, why would you listen to anyone else? Like Buffett, The Buffett Way Financial Coaching does not advocate trying to predict markets, the economy, or how politics or election results influence markets. All research suggests that market timing these events is impossible, so we ignore them. Rather, The Buffett Way Financial Coaching adheres to Buffett’s philosophy, The Buffett Way, which is simply owning a part of a business v. trading stocks on Wall Street. Buffett says it best, “As far as I’m concerned, the stock market doesn’t exist. It is there only as a reference to see if anybody is offering to do anything foolish.” In other words, have the attitude and orientation of a business owner. Why? Because you are. Lastly, as experts on The Buffett Way, The Buffett Way Financial Coaching has simplified The Buffett Way for the individual investor. The Buffett Way of Investing is easy for the individual investor to understand, and with our Professional Coaching, implement.

The Buffett Way Explained

Being a visionary leader is different than being a capable manager. The Buffett Way invests alongside the best business leaders and visionary entrepreneurs in the world. Throughout time, the most visionary and innovative leaders win. A specific example of this can even be seen at Berkshire Hathaway itself under the visionary leadership of Warren Buffett and Charlie Munger.

| Warren Buffett

|

Charlie Munger

|

|

|

Known for Leadership of Berkshire Hathaway

with Charlie Munger

|

Known for Leading investments at Berkshire Hathaway

with Warren Buffett

|

Secondly, The Buffett Way subscribes to stable financials with manageable to zero debt. Interestingly, Buffett has found that by adhering too strictly to typical financial formulas many investors miss out on some of the best opportunities. A few specific examples are Facebook, AMD, and Chipotle.

The third primary ingredient of The Buffett Way is a product or service that people love. Think Apple’s iPhone or Facebook. Investors don’t need Wall Street or a TV pontificator to know what products or services people love. If you want to know if Home Depot is busy, go to The Home Depot. If you want to know what social media platform teens are using, ask them. Of course, investing isn’t this simple; hence, the other two ingredients to The Buffett Way.

The Right Leadership + the Right Financials + the Right Product or Service sums up The Buffett Way. Take a closer look at your own investing track record. Compare your results to Buffett’s. Then, contact us, and we will get you investing the right way, The Buffett Way.

BUFFETT'S PERFORMANCE

Keep in mind, your net investment return is the money you put into your pocket, not ours. In more specific financial terms, your net investment return is the percentage gain after all expenses, fees, trading costs, opportunity costs, risk, and taxes (only for taxable accounts). Do you know what your net investment returns currently are?

Research Report on INDIVIDUAL INVESTOR RETURNS.

Stay Connected: